|

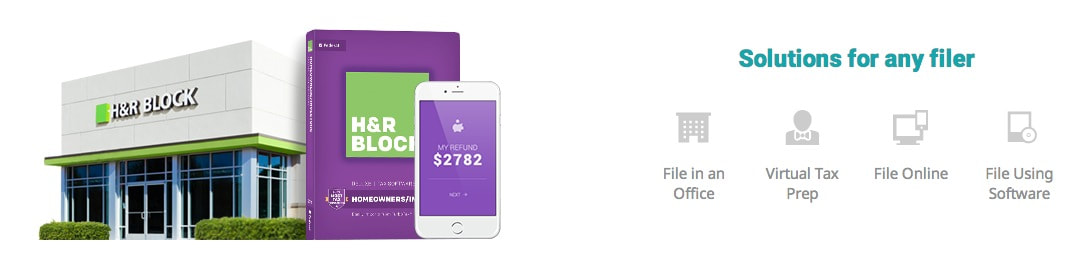

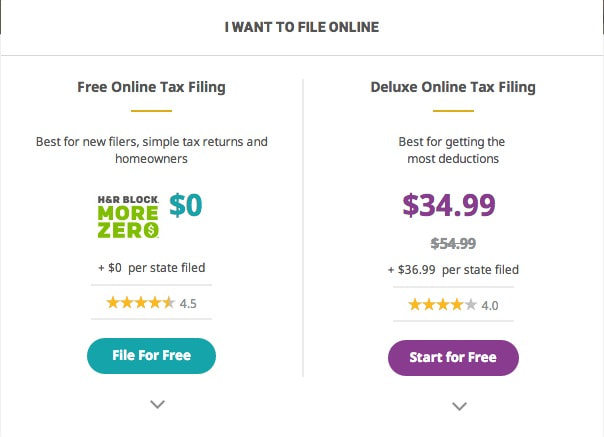

*I was provided a product in exchange for my review, but all opinions are my own. If you're looking to file your taxes this year in a simple and easy way, then I highly recommend using H&R Block. Not only can file from the comfort of your own home online, it's also very easy and free if you only need to submit a basic return! However, if you're one of those people that would rather speak with someone in person face to face, they have offices you can go to as well. This post, however, will be about my experience filing online. Filing online on your own may seem like a daunting task, but when I say filing with H&R Block is easy, it truly is! They guide you and ask you questions, and you simply input the information you have. The then fill out the forms based on your responses and information. They also have the ability to import your W-2, skipping the need for you to even have to input your income information. It is truly a simple, easy, some may say even fun process. I like how I can see as I go what my refund is based on what I've entered. Since I do write for a blog, our taxes are a bit more complex since I have self employment income. I chose H&R Block because I want to make sure I'm getting everything right when it comes to filing our taxes. I also used the Tax Pro Review Add On, which gave me the added assurance that everything is being verified that it is correct and that we got the max refund possible. Tax Pro Review℠ gives DIY clients the opportunity to have their completed return reviewed by a tax professional – check/sign/e-file return with a tax professional without going into a tax office. You get secure document upload and one-on-one communication. Tax returns are delivered to clients for review within three days, while competitor turnaround is three business days. All H&R Block tax pros receive training beyond the minimum standards to remain registered with the IRS. The add-on cost for this service is $49.99-89.99 based on the complexity of your tax return. Also, they offer the option to have your payment (if there is any) deducted from your return, so essentially you pay no money out of pocket for the services. You can check your refund status online in real time. They can also do direct deposit so the refund is in your bank account in as short of a time as possible.

Overall, H&R Block was the best price and value I found for a DIY tax return, and I would highly recommend using them to get your taxes done quickly and easily this year.

0 Comments

|

Categories

All

Archives

March 2021

|

Privacy Policy for www.mommyof2embracinglife.com

The privacy of our visitors to www.mommyof2embracinglife.com is important to us.

At www.mommyof2embracinglife.com, we recognize that privacy of your personal information is important. Here is information on what types of personal information we receive and collect when you use and visit www.mommyof2embracinglife.com, and how we safeguard your information. We never sell your personal information to third parties.

Log Files

As with most other websites, we collect and use the data contained in log files. The information in the log files include your IP (internet protocol) address, your ISP (internet service provider, such as AOL or Shaw Cable), the browser you used to visit our site (such as Internet Explorer or Firefox), the time you visited our site and which pages you visited throughout our site.

Cookies and Web Beacons

We do use cookies to store information, such as your personal preferences when you visit our site. This could include only showing you a popup once in your visit, or the ability to login to some of our features, such as forums.

We also use third party advertisements on www.mommyof2embracinglife.com to support our site. Some of these advertisers may use technology such as cookies and web beacons when they advertise on our site, which will also send these advertisers (such as Google through the Google AdSense program) information including your IP address, your ISP , the browser you used to visit our site, and in some cases, whether you have Flash installed. This is generally used for geotargeting purposes (showing New York real estate ads to someone in New York, for example) or showing certain ads based on specific sites visited (such as showing cooking ads to someone who frequents cooking sites).

You can chose to disable or selectively turn off our cookies or third-party cookies in your browser settings, or by managing preferences in programs such as Norton Internet Security. However, this can affect how you are able to interact with our site as well as other websites. This could include the inability to login to services or programs, such as logging into forums or accounts.

RSS Feed

RSS Feed